Stable inland transport infrastructure investment share of GDP in OECD

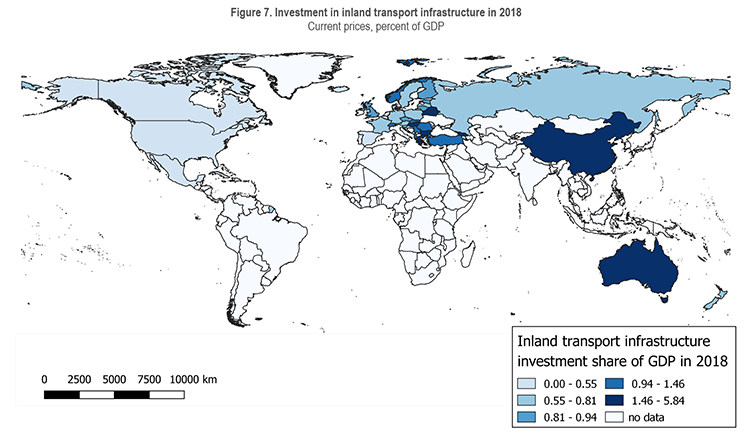

- OECD investments in inland transport infrastructure as a percentage of the GDP remained stable at 0.7% in 2018.

- China continued to have the highest inland transport infrastructure investment share of GDP in 2018 (5.7%) and was among the fastest growing countries in terms of volume of inland transport infrastructure investment (+252% between 2008 and 2018 in constant 2015 prices).

- Inland transport infrastructure investments shifted from spending on roads to spending on railways in Slovenia, Denmark, Mexico, and France when comparing 2008 to 2018. Road shares of total inland transport infrastructure declined in these countries by 25-29%.

- Public maintenance spending on roads was over 50% of total road expenditure in Austria, Denmark, Italy, Moldova, New Zealand and Slovenia in the latest available data.

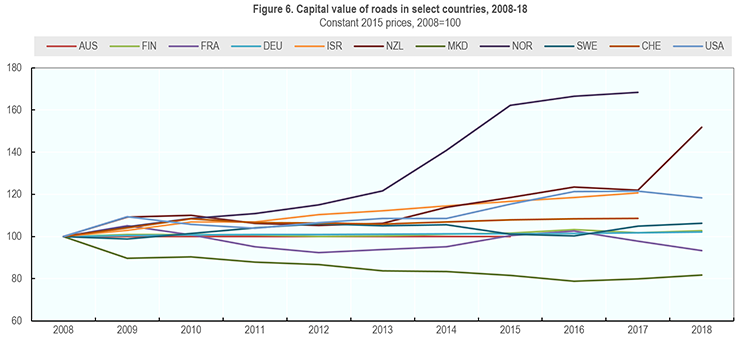

- Norway experienced the most visible growth in capital value of roads between 2008 and 2017 among countries with available data (+68% in constant 2015 prices).

Investment trends for inland transport infrastructure

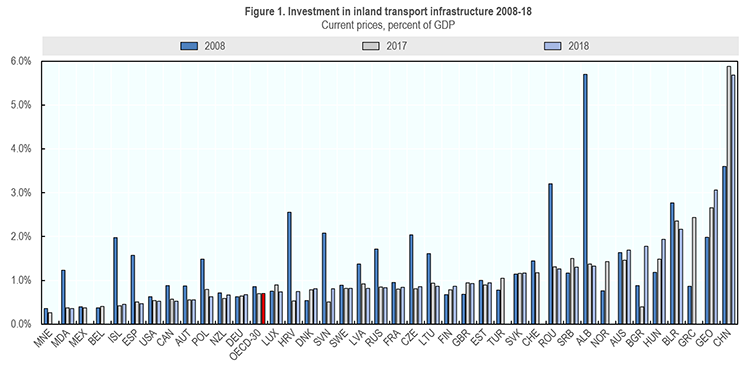

The OECD gross fixed capital formation (investment) in inland transport infrastructure expressed as a percentage of the Gross Domestic Product (GDP) remained stable at 0.7% in 2018. The aggregate level has been constant since 2014, after declining from a peak of 0.9% in 2009. The OECD aggregate does not include Chile, Ireland, Israel, Korea, the Netherlands and Portugal. Data are estimated for Belgium, Greece, Italy, Japan, Mexico, Norway, Switzerland and Turkey.

In 2018, the highest inland transport infrastructure investment as a percentage of GDP was in China (5.7%), Georgia (3.1%), Belarus (2.2%), Hungary (1.9%), Bulgaria (1.8%) and Australia (1.7%; Figure 1). Since 2008, inland transport infrastructure investment shares of GDP grew most notably in China (+2.1 percentage points), Georgia (+1.1), Bulgaria (+0.9) and Hungary (+0.7). Between 2017 and 2018, inland transport infrastructure investment shares of GDP decreased slightly in China (-0.2) while increasing in Bulgaria (+1.4), Hungary (+0.5), Georgia (+0.4) and Slovenia (+0.3).

The lowest levels of investment in inland transport infrastructure as a percentage of the GDP among countries with 2018 data were observed in Moldova (0.4%), Iceland, Spain and the United States (all 0.5%). However, differences in data coverage limit the validity of country-level comparisons. Since 2008, there have been declines in inland transport infrastructure investment shares of GDP in Albania (-4.4 percentage points), Romania (-2.0), Croatia (-1.8), and Iceland (-1.5). Between 2017 and 2018, in addition to the decline in China, there was also a decrease in investments in inland transport infrastructure shares of GDP in Belarus, Luxembourg, Poland and Serbia (all -0.2).

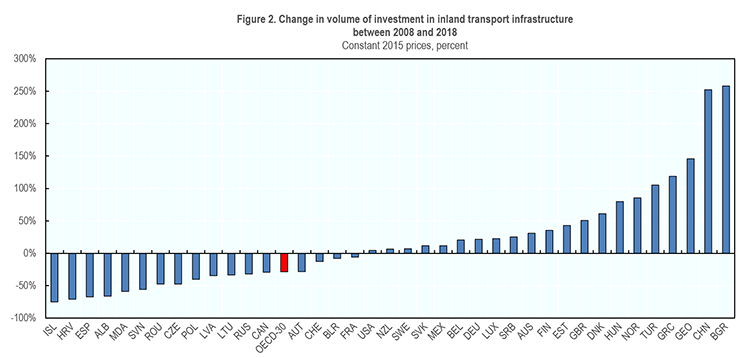

China experienced consistent growth in inland transport infrastructure investment from 2011 to 2017 (Figure 3; constant prices). While this trend has recently begun to level off, China remains one of the fastest growing countries in terms of volume of spending on inland transport infrastructure in constant 2015 prices (+252%; Figure 2).

Significant increases in inland transport infrastructure investments between 2008 and 2018 have also taken place in Bulgaria (+256%) and Georgia (+146%). Data available until 2017 indicate strong growth in Turkey (+147%) and Greece (+127%).

A decline in the volume of inland transport infrastructure investment since 2008 (in constant 2015 prices) has occurred in Iceland (-75%), Croatia (-71%), Spain (-67%) and Albania (-66%). The OECD volume of investment in inland transport infrastructure in constant prices decreased by 31% from 2008 to 2018.

Shifts in investments between road and rail

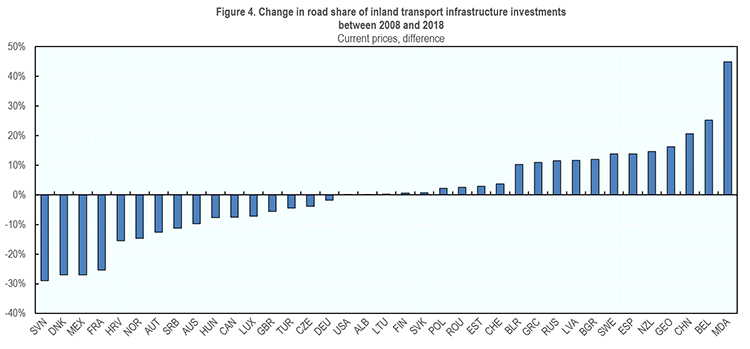

The share of investment in roads among total inland transport infrastructure investment grew between 2008 and 2018 in Moldova (+45%), Belgium (+25%), and China (+21%). It declined in Slovenia (-29%), Denmark, Mexico (both -27%), and France (-25%; Figure 4). In Moldova, road spending declined (-23% since 2008 in constant 2015 prices), but the even stronger decrease in rail investment (-97%) resulted in a higher share for road investment.

Conversely, the increase in road shares of inland transport investments in Belgium and China was due to road investments nearly quadrupling in the former and quintupling in the latter. Among the countries with declines in road shares of inland transport infrastructure investment between 2008 and 2018, Slovenia, Mexico and France all invested less in roads (-71%, -24% in 2017, -38%) and more in rail (+49%, +196%, +90%) in constant 2015 prices. Denmark experienced a negligible change in road investments and an increase in rail investments (+213%), leading to a decrease in the road share.

Road maintenance

Efficient and timely maintenance of roads is critical to ensuring their prolonged use and the safety of road users. The ITF report "Policies to Extend the Life of Road Assets" recommended twelve measures for extending the life span of road assets.

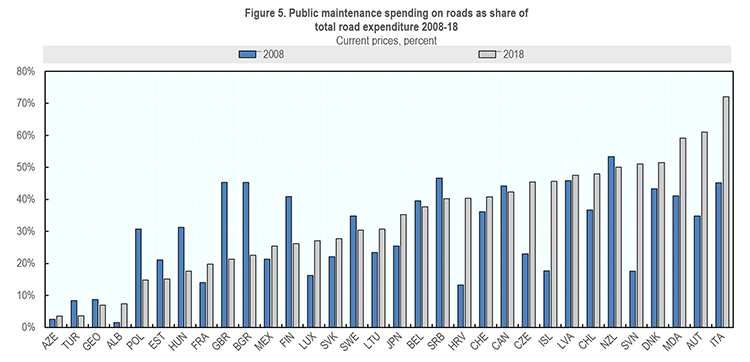

Public maintenance spending on roads as a share of total road expenditure was highest in Italy (72%), Austria (61%), and Moldova (59%). It was lowest in Azerbaijan and Turkey (both 4%), according to the latest available data (Figure 5).

Between 2008 and 2018, the public maintenance share of spending on roads increased most visibly in Slovenia (+34 percentage points), Iceland (+28), Croatia, Italy (both +27), Austria (+26) and the Czech Republic (+22). The growth in Austria, Croatia, the Czech Republic, and Slovenia was due to increases in road infrastructure maintenance (+33%, +6%, +37%, and +45%) in conjunction with reduced road investments (-55%, -76%, -51%, and -71%) in constant prices. Conversely, the growth in share of public maintenance spending on roads in Iceland and Italy was due to declines in road investments in constant prices (-75%, -76%), as road maintenance spending also decreased over the same period (-3%, -26%).

The maintenance share of public spending on roads declined most in in the United Kingdom (-24 percentage points) and Bulgaria (-23) over the period 2008 to 2018. The decrease in the United Kingdom was due to greater investments in road infrastructure (+31%, in constant prices), as well as declines in road maintenance spending (-57%). Bulgaria experienced the fastest growth in road maintenance spending in constant prices among the countries mentioned between 2008 and 2018. However, its growth in road investments was notably stronger, increasing fourfold, which created a decline in its road maintenance share of spending.

Capital value of roads

With an increase of 68% in constant 2015 prices, Norway saw the most visible growth in the capital value of roads among countries with available data between 2008 and 2017 (Figure 6). During the same period, Norway increased road investment (+55%) and road maintenance spending (+53%) at faster rates than all other countries included in Figure 6. The rapid growth in the capital value of roads in New Zealand by 24% between 2017 and 2018 coincides with a 19% increases in road investments and a 13% increase in road maintenance spending in constant prices.

A comparison of 2008 data with the latest available figures shows increases in the capital value of roads in Israel (+21%), the United States (+18%), Switzerland (+9%), Sweden (+6%), Finland (+3%) and Germany (+2%). Among the countries in Figure 6, the capital value of roads declined most visibly between 2008 and 2018 in North Macedonia (-18%), which also experienced the strongest decline in maintenance spending on roads over the referenced period among these countries (-32%, constant 2015 prices). Since 2008, there has been a slight decline in the capital value of roads for France of 7%.

Note: 2017 data used for Belgium, Italy, Japan, Mexico, Switzerland and Turkey.

Note: 2017 data used for Belgium, Italy, Japan, Mexico, Switzerland and Turkey.

Note: 2017 data used for Belgium, Italy, Japan, Mexico, Switzerland and Turkey.

Note: 2017 data used for Belgium, Italy, Japan, Mexico, Switzerland and Turkey.

Subscribe to ITF Statistics Briefs

About the statistics

The International Transport Forum statistics on investment, maintenance expenditure and capital value of transport infrastructure for 1995-2018 are based on a survey sent to current ITF member countries. The survey covers total gross investment (defined as new construction, extensions, reconstruction, renewal and major repair) in road, rail, inland waterways, maritime ports and airports, including all sources of financing. It also covers maintenance expenditures financed by public administrations and capital value of transport infrastructure.

The Secretariat collects data from member countries in national currencies, which are then converted to current prices and constant euros. There have been significant efforts devoted to collecting relevant deflators needed to calculate the constant euro equivalent of data provided, since there exists no purchasing power parity corrected general index for transport infrastructure investment. Where available, a cost index for construction on land and water is used. Where these indices are not available, a manufacturing cost index or a GDP deflator is used.

Despite the relatively long time series, these data are often dogged by definition and coverage inconsistencies between countries, which make international comparisons difficult. For the capital value data in particular, there are notable differences in precision of estimation methods. The capital value of infrastructure is most commonly estimated using historical cost accounting with the perpetual inventory method (PIM) or current cost accounting, which evaluates the current value of all assets. We therefore advise caution when making comparisons of data between countries and instead recommend comparisons of trends. Furthermore, when analysing the capital value data or indicators such as the inland transport infrastructure investment share of GDP, it is important to take into account the quality and age of existing infrastructure, the maturity of the transport system, the geography of the country, the transport-intensity of its productive sector and its transport infrastructure developments.

If you would like to receive more information about this Statistics Brief, please contact Ms Ashley Acker (ashley.acker@itf-oecd.org). Detailed country data for inland modes, maritime ports and airports along with more detailed data descriptions and notes on the methodologies are available at: https://stats.oecd.org/Index.aspx?DataSetCode=ITF_INV-MTN_DATA.

OECD aggregate

The OECD-30 aggregate does not include Chile, Ireland, Israel, Korea, Netherlands and Portugal. The following data on road or rail investment are estimated using secondary sources: Belgium 2018, Greece 2018, Italy 2017-18, Japan 2017-18, Mexico 2018, New Zealand 2000-06, Norway 2018, Switzerland 2018, and Turkey 2018.

Disclaimer

This document, as well as any data and map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD/ITF is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.